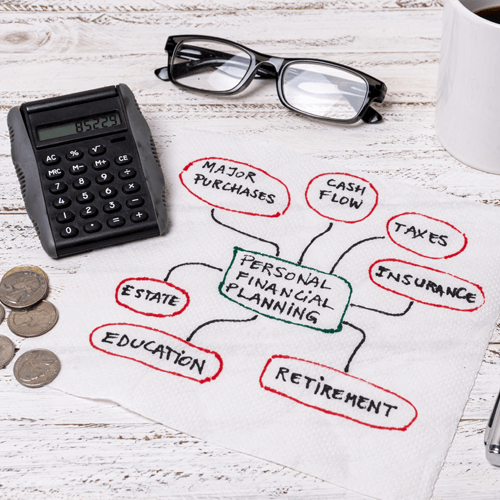

Create a budget. Determine what you actually spend each month. There are fixed expenses like rent, loan repayments, etc. every month about which we can do little. The variable items such as food, clothing and entertainment are often what get away from us. Use your discretion to contain these variable expenses to start saving.